Are you curious about the future of lithium prices? As one of the most critical elements in modern technology, lithium has become a hot topic for investors and analysts alike. Over the past decade, we’ve seen significant fluctuations in its value, leaving many wondering what’s next for this valuable resource. In this blog post, we’ll explore the history of lithium prices and take a deep dive into predicting what 2024 has in store for us. So sit back and get ready to learn all about this fascinating element that powers our lives!

The History of Lithium Prices

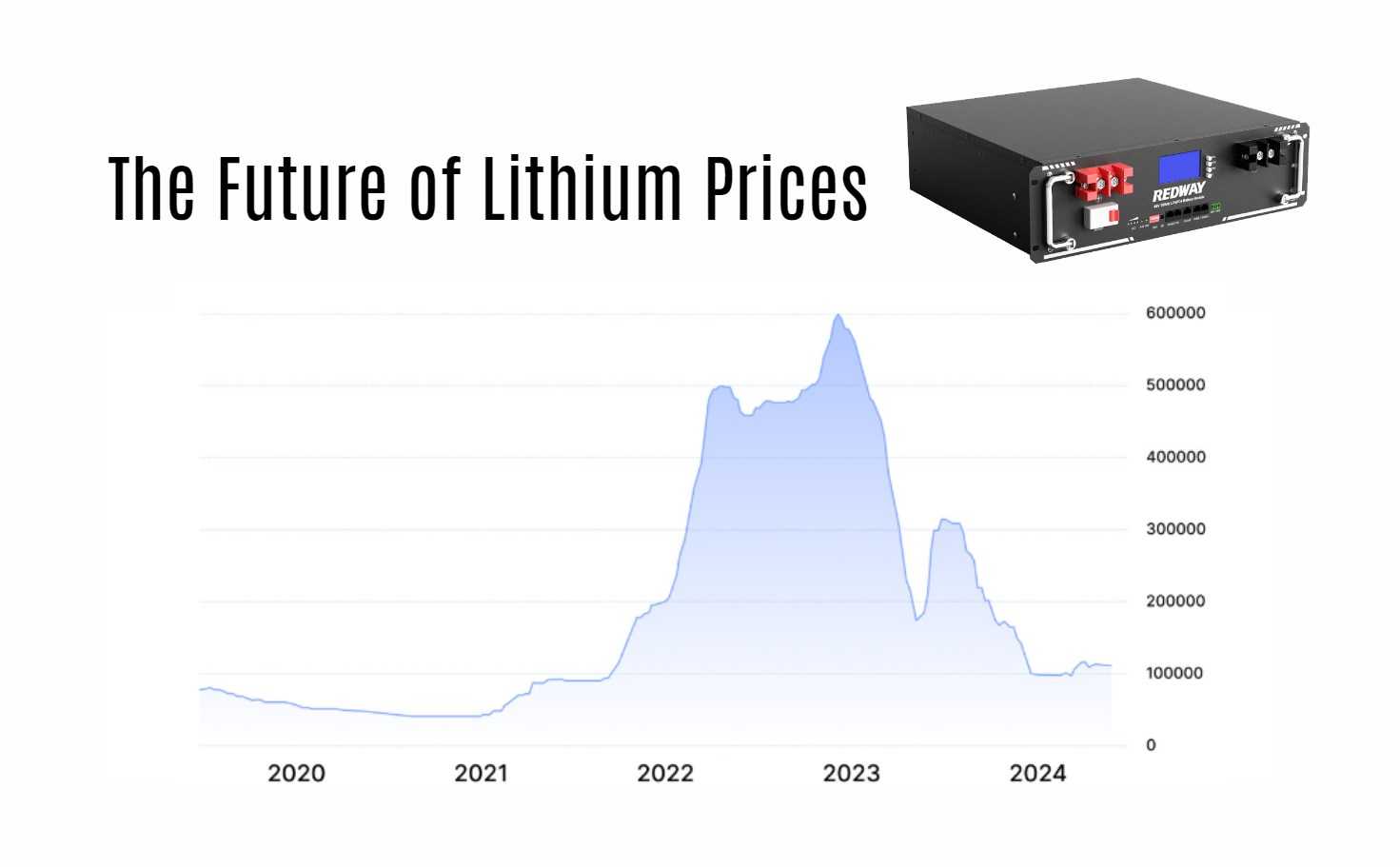

The history of lithium prices dates back to the early 2000s when demand for lithium-ion batteries began to soar. At that time, the price of lithium was around $1,500 per tonne. However, as demand grew and supply struggled to keep up, prices spiked drastically.

In 2015, China’s plan to build a massive electric vehicle industry sent global lithium prices soaring from less than $6k/tonne in mid-2015 to more than $20k/tonne by mid-2017. That was an increase of over 300%! This surge led many investors and miners scrambling for a piece of the action.

Despite this boom period, there were some setbacks along the way. In late 2018 and early 2019, oversupply concerns emerged due to new mines opening faster than demand could grow. This caused a dip in pricing which made it difficult for smaller producers who had invested heavily in infrastructure.

Despite some ups and downs throughout history – one thing is clear: Lithium has been on an upward trend over the past decade with no signs of slowing down anytime soon!

The Future of Lithium Prices

The future of lithium prices is a topic that has been widely discussed since the world’s transition towards renewable energy sources. Lithium, which is a crucial component in electric vehicle batteries, has seen significant price fluctuations over the years due to supply and demand issues.

Experts predict that as more countries aim for carbon neutrality, there will be an increase in demand for lithium-ion batteries. This rise in demand could cause prices to skyrocket unless new sources of lithium are discovered or current mining operations ramp up production.

However, with advancements in battery technology and research into alternative materials to replace lithium-ion batteries, it’s uncertain how long this trend will continue. Some experts believe that by 2024 we may see a shift towards cheaper alternatives or even a decrease in the demand for traditional lithium-ion batteries altogether.

While the future of lithium prices remains unpredictable, it’s clear that the importance of finding sustainable solutions for our energy needs cannot be understated. The key to securing stable pricing lies not only in discovering new sources but also exploring other avenues such as recycling and improving battery efficiency.

Conclusion

The demand for lithium is expected to continue growing as electric vehicles and renewable energy sources become more prevalent. While there may be short-term fluctuations in prices, the long-term outlook is positive for those investing in lithium mining and production.

As with any market, it’s important to keep an eye on trends and stay informed about global economic factors that could impact the price of lithium. But ultimately, experts predict that by 2024 we will see a rise in demand for lithium leading to increased prices.

Investors looking to capitalize on this trend should consider carefully researching companies involved in the production and exploration of lithium resources. With careful consideration and a bit of luck, investing in this exciting industry could lead to significant returns over the coming years.